What is an ITIN?

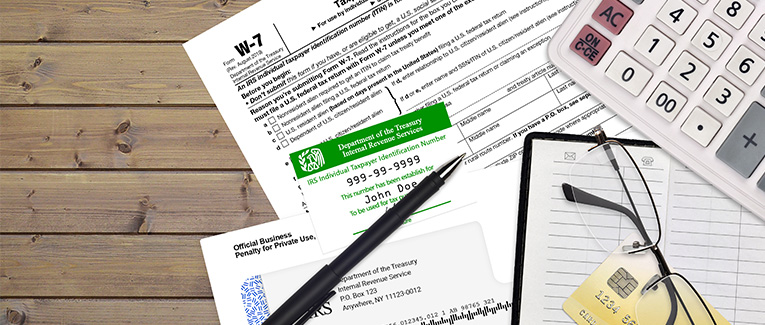

ITIN or an Individual Taxpayer Identification Number is a tax processing number issued by the Internal Revenue Service (IRS), income tax department of the US. ITIN is a nine digit number and always begins with the number 9 and has a 7 or 8 in the fourth digit, such as 9XX-7X-XXXX.

IRS issues ITIN only to those individuals who are required to have a US taxpayer identification number but do not have and are ineligible to obtain, a Social Security Number (SSN) from the Social Security Administration (SSA). ITINs allow individuals to comply with the US tax laws and provide a means to efficiently process and account for tax returns and payments for those not eligible for Social Security Numbers.

Need and Eligibility for ITIN

If you do not have an SSN and are not eligible to obtain an SSN, but you have a requirement to furnish a federal tax identification number or file a federal income tax return, you must apply for an ITIN. By law, an alien individual cannot have both an ITIN and an SSN.

ITINs are issued regardless of immigration status because both resident and nonresident aliens may have U.S. tax return and payment responsibilities under the Internal Revenue Code.

In order to be eligible for ITIN, you must fall into one of the following categories:

- Non-resident alien who is required to file a US tax return

- US resident alien who is (based on days present in the US) filing a US tax return

- Dependent or spouse of a US citizen/resident alien.

- Dependent or spouse of a nonresident alien visa holder such as H4 visa holder.

- Nonresident alien claiming a tax treaty benefit

- Nonresident alien student, professor or researcher filing a US tax return or claiming an exception.

Limitations of ITIN

ITINs are used for federal income tax purposes only. It is not intended to serve any other purpose. It has several limitations or restrictions:

- Individuals must have a filing requirement and file a valid federal income tax return to receive an ITIN, unless they meet an exception, as described in Form W-7 Instructions.

- ITIN does not authorize work in the U.S.

- ITIN does not provide eligibility for Social Security benefits or the Earned Income Tax Credit.

- ITINs are not valid identification outside the tax system. Since ITINs are strictly for tax processing, the IRS does not apply the same standards as agencies that provide genuine identity certification. ITIN applicants are not required to apply in person, and the IRS does not further validate the authenticity of identity documents. ITINs do not prove identity outside the tax system, and should not be offered or accepted as identification for non-tax purposes.

However, ITIN filers can claim the Child Tax Credit and Additional Child Tax Credit, as appropriate.

Application for ITIN

You need the following documents to apply for ITIN:

- Form W-7. Make sure to read Form W-7 instructions.

- Your federal tax return. However, if you qualify for an exception instead, enclose supporting documentation for an exception.

- Original documentation or certified copies from the issuing agency to prove identity and foreign status.

Because you are filing your tax return as an attachment to your ITIN application, you should not mail your return to the address listed in the Form 1040, 1040A or 1040EZ instructions. Instead, send your return, Form W-7 and proof of identity documents to the address listed in the Form W-7 instructions. On subsequent years, you would file your tax returns, as mentioned in the tax form instructions.

Supporting Documents for Applying ITIN

The following supporting documents can be used to prove identity and foreign status:

| Supporting Documentation | Can be used to establish: | |

| Foreign status | Identity | |

| Passport (the only stand-alone document) | X* | X |

| U.S. Citizenship and Immigration Services (USCIS) photo identification | X | X |

| Visa issued by U.S. Department of State | X | X |

| U.S. driver’s license | X | |

| U.S. military identification card | X | |

| Foreign driver’s license | X | |

| Foreign military identification card | X | X |

| National identification card (must be current and contain name, photograph, address, date of birth and expiration date) | X | X |

| U.S. state identification card | X | |

| Foreign voter’s registration card | X | X |

| Civil birth certificate | X** | X |

| Medical records (valid only for dependents under age 14 (under age 18 if a student)) | X** | X |

| School records (valid only for dependents under age 14 (under age 18 if student)) | X** | X |

| * Applicants claimed as dependents who need to provide US residency must provide additional original documentation if the passport doesn’t have a date of entry into the US. ** May be used to establish foreign status only if documents are foreign. Can be used to establish foreign status only if they are foreign documents. | ||

Timeline for Applying for ITIN

You should complete Form W-7 as soon as you are ready to file your federal income tax return, since you need to attach the return to your application.

If you meet one of the exceptions and do not need to file a return, submit Form W-7, along with the documents required to meet your purpose for needing an ITIN. Do this as soon as possible after you determine that you are covered by that exception.

You can apply for an ITIN any time during the year; however, if the tax return you attach to Form W-7 is filed after the return’s due date, you may owe interest and/or penalties. You should file your current year return by the April 15 deadline to avoid this.

Timeline for Receiving ITIN

If you qualify for an ITIN and your application is complete, you will receive a letter from the IRS assigning your tax identification number. The IRS does not mail ITIN in a card format but instead as in an authorization letter format to avoid any possible similarities with a Social Security Number card.

If you have not received your ITIN or other correspondence two months after applying, you may call the IRS at toll-free (800) 829-1040 or at +1 (267) 941-1000 to find out the status of your application.

IRS will return your original documents to the mailing address provided in Form W-7. You don’t need to provide them with a return envelope.

Application Alternatives

IRS may take around two months to process your ITIN and return your original documents. If you need the documents back sooner or if you don’t want to send them, you can apply in person either at an IRS Taxpayer Assistance Center (TAC) or with an IRS-authorized Certifying Acceptance Agent (CAA).

TACs in the United States provide in-person help with ITIN applications on a walk-in or appointment basis. Applicants outside the United States should contact an overseas IRS office to find out if that office accepts Form W-7 applications. The IRS’s ITIN Unit in Philadelphia issues all numbers by mail.

A Certifying Acceptance Agent is an individual, business or organization (college, financial institution, accounting firm, etc.) authorized by IRS to assist individuals in obtaining ITINs. Acceptance Agents review applicants’ documentation, complete a certificate of accuracy, and forward the certificate and application to the IRS for processing. Some Acceptance Agents may charge a fee. They can verify the original documents and mail only the photocopies of the documents, and assist in responding to the IRS if they need more information to process the refund. They may also be able to assist in other languages that you may be more comfortable with.

Renewal of ITIN

You don’t need to renew your expiring or expired ITIN in many situations such as:

- You have an SSN or you are eligible for an SSN.

- ITIN is only being used on information returns filed with the IRS by third parties such as on Form 1099.

- You will not be filing a US federal tax return using the ITIN.

- You don’t need to be claimed as a dependent on a US federal tax return.

However, you would need to renew your ITIN in certain scenarios:

- Middle digits of your ITIN are 70, 71, 72, 78, 79, 80.

- Middle digits of your ITIN are 73, 74, 75, 76, 77, 81 or 82.

- If middle digits of your ITIN are not from the numbers above and you have not filed a US federal tax return using an ITIN (or ITIN was used for a spouse or dependent) for tax year 2015, 2016 or 2017.

If your ITIN has expired and you file a tax return with that, the return will still be processed and treated as timely filed. However, you will not be paid any refund and you will not be eligible for any exemptions and/or credits claims. Instead, you will receive a notice from the IRS that the ITIN has expired and explaining the delay in any refund.

Application for Renewal of ITIN

In order to submit an application for renewal of ITIN, you need:

- Form W-7. Make sure to select the reason why you need ITIN, as per Form W-7 instructions.

- Original identification documents or certified copies by the issuing agency.

- Any other required documents, as described above in the new application section for ITIN.

Unlike the application for a new ITIN, a tax return is not required with a renewal application.